When Agents Attack: How AI Collapses and Rebuilds Marketplace Moats

AI is coming for marketplaces. OpenAI launched its agent product last week. Agents in the future can take over discovery, transactions, and even supply workflows, undermining the network effects that made marketplaces defensible, leading to product/market fit collapse and completely changing how you need to think about your acquisition costs. Here’s how these agents will potentially work and the five moves founders should make to stay ahead.

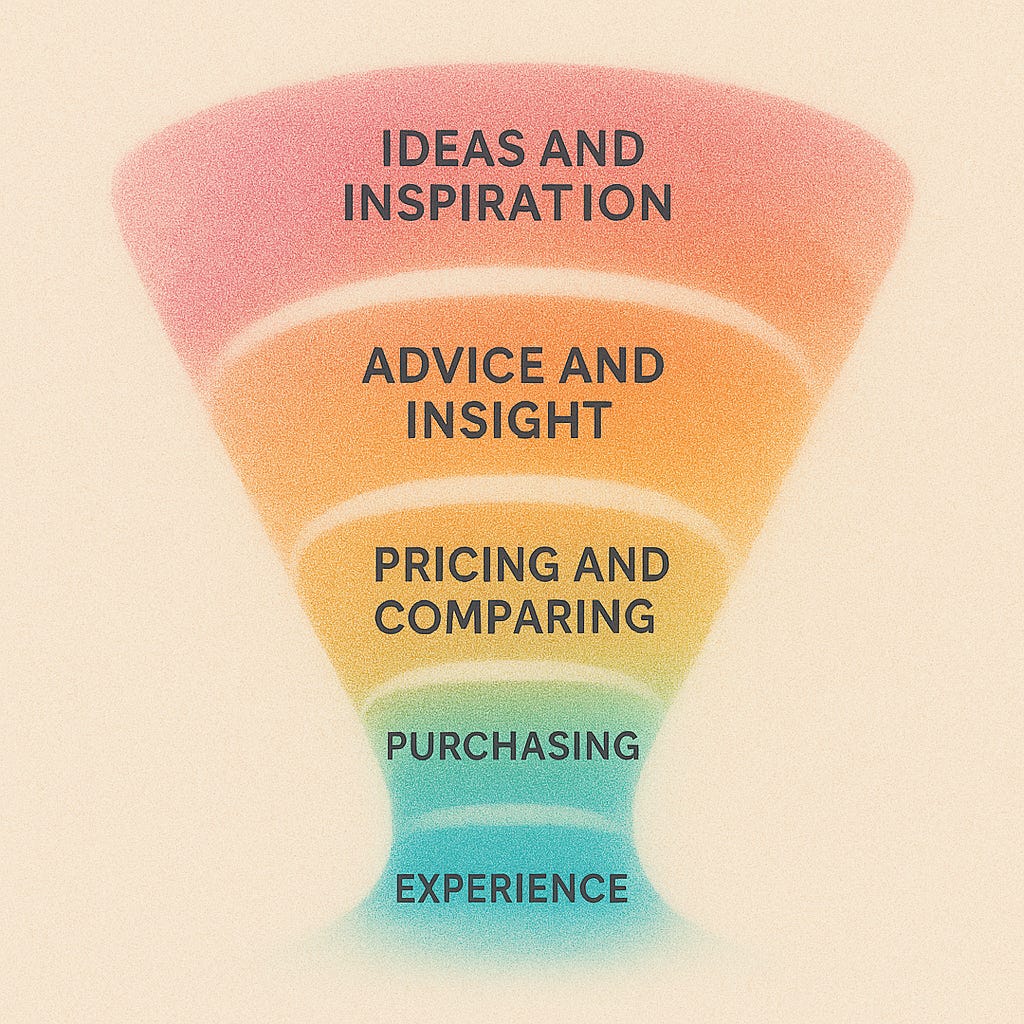

The Traditional Purchase Funnel

A lot of unfulfilled excitement around LLM products is how LLM products like ChatGPT could compress the discovery journey. The historical marketing funnel for high consideration decisions starts with ideas and inspiration, advice and insight, pricing and comparing, and purchase and experience.

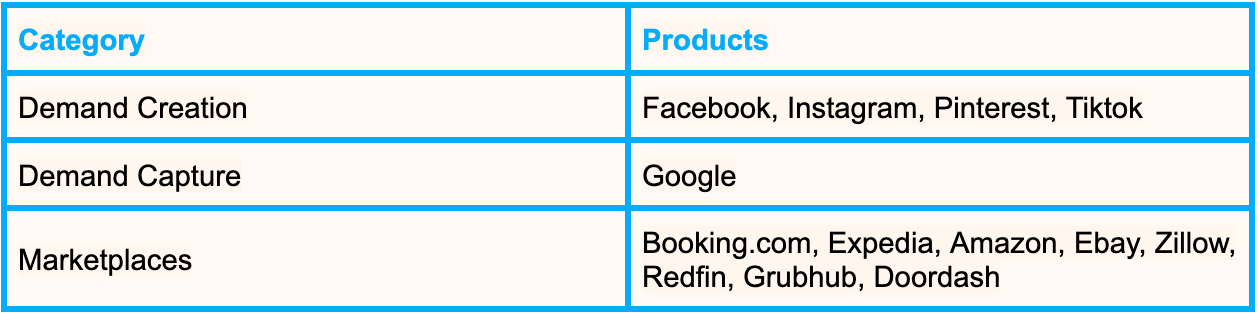

The early consumer internet excelled at pricing and comparison, and many won here by making purchasing seamless too. This is where marketplaces thrived in many industries like travel (Expedia/Booking), physical goods (Ebay/Amazon), real estate (Zillow/Redfin) and food (Grubhub/Doordash). Google as a search engine perceived its job to be to get you to the best site for this type of comparison and purchase as quickly and accurately as possible.

Much of the first two steps happened offline in the early internet, and started to be brought online in the age of social and content networks like Facebook, Instagram, Pinterest, and Tiktok. But none of these platforms have been able to extend very well into the traditional marketplace steps of pricing, comparison, and purchase despite dozens of attempts. Marketers called these destinations demand creation and demand capture, and managed them somewhat distinctly. Unifying them with metrics has always proved difficult.

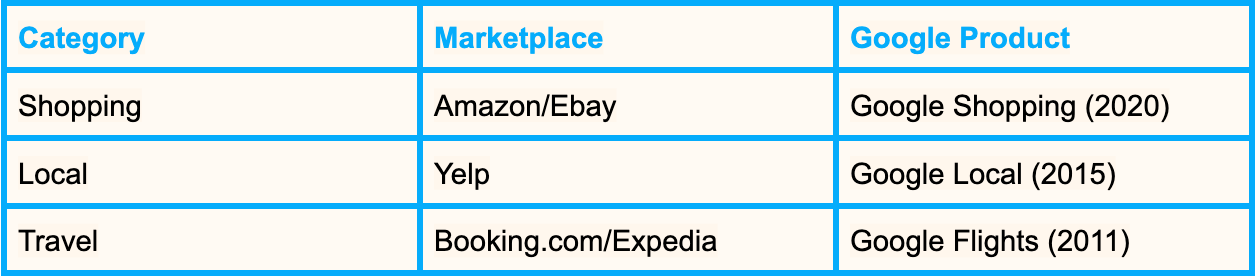

LLMs can now collapse this funnel, and about a dozen years ago Google was the first to change its tune. Instead of being content with being the traffic router to the best marketplace, it started to expand its mission to solve your problem directly. Mobile made comparison slow, so Google began solving it in‑house. Google approached solving this problem by looking at the top categories of searches and either incubating (Google Local, Google Shopping) or acquiring (Google Flights) competition to the marketplaces they used to happily send this traffic to. That vision has continued to expand to this day with some success.

Discovery Agents

In an agentic world, an LLM that has a deep understanding of your preferences will be theoretically be the first to understand new intent to give you ideas and inspiration for, will have the best understanding of what choices are reasonable for you, taking away a lot of pricing and comparison work search engines and social networks have had to delegate to marketplaces in the past. This collapse of the marketing funnel changes the customer acquisition economics of every marketplace.

Bill Gurley recently argued that when ChatGPT rolls out ads, it will want a share of the billions Booking.com and others now spend on Google. If agents do the discovery, marketplaces will still bid—but far less—because they lose downstream lifetime value potential.

We've talked about this in the past but but I've often felt that one of the reasons that Google is so susceptible to disruption is how they've maximized the revenue per visitor, and I personally don't think there's any way when that world you're talking about that agent world evolves that that partner in a hotel is going to pay a fee anywhere close to the fee that's paid to Google by someone that's marketing a service that I always say using “LTV math” versus transactional math. I just don't think there's any way you can get there and, so that's a huge disruptive advantage for OpenAI. - Bill Gurley

Why payback math breaks in an agentic world

Marketers today assume that visitors build brand affinity, convert (where the marketplace takes a cut), and can be re-marketed to. This increases the chances of direct purchases in the future. Therefore, a marketer might measure that transaction cost on a payback period basis based on the lifetime value of similar customers from that channel.

In a world where agents potentially do all that discovery and booking work for the user, the marketplace receives potentially none of those benefits. Sure, the marketplace will take the additional transaction revenue, but it will no longer use payback period math, but unit economic math for a single transaction as it can no longer feel confident it’s acquiring the ability to do future outreach, create brand preference, and increase the chances of direct purchases in the future.

The higher frequency the activity, the more likely one can create an experience that retains better than a generic discovery agent experience. Retention is primarily influenced by:

Natural frequency: how often do I need the value prop of this service?

Loyalty: when I have this value prop, how often will I use the same service?

Memory, or personalization, should also help existing apps that have had frequent usage in the past maintain direct relationships moving forward as vertical discovery agents. Personalization can be thought of as a first order effect of a data network effect to increase engagement. It frequently has a second order effect of making experiences for new users better as well because most new users benefit from the data of existing users on what is good and not good. This is part of how Pinterest doubled its activation rate while I was there.

How founders should react to discovery agents

Switch to payback on first purchase for transactions that are sourced directly from discovery agents

Fortify brand hooks with customers via the website experience post the handoff from the LLM

Focus on high frequency markets that will benefit from optimized experiences and personalization

Transactional Agents

When agents stop at discovery, marketplaces still have a chance to build loyalty. When they also execute the purchase, the marketplace disappears entirely. This is a losing scenario.

Many marketplaces would object to transactional agents initially and try to block them. But can they? LLMs don’t have an equivalent of robots.txt that their agents will adhere to, and new protocols like MCP clear the way for these agentic workflows with personal information and credit card data regardless of a marketplace’s decision to integrate with an LLM or not.

If you can block agents, you might miss out on increased impressions from discovery agents or more transaction volume if people use a dedicated transactional agent from OpenAI or Google for most tasks. In marketplace verticals historically, the top supplier with a very high market share can opt out of participating in the marketplace, confident in its marketing ability to bring people directly to their product. Southwest Airlines not integrating with any flight marketplaces is a famous example. But everyone else needs the volume despite the lack of direct relationship with the customer. Even Domino’s eventually got on Doordash.

If the transactions still occur offline, that presents a marketing opportunity for the marketplace. If a marketplace is working with physical inventory in the real world, as it scales, it has the opportunity to use that real world inventory to promote the marketplace brand. Grubhub tended to leverage signage, dedicated business cards, stickers etc. inside the restaurants it worked with to drive more awareness. This became the source of over 15% of new users. This tactic may need to be dialed up more aggressively for marketplaces in an age of AI.

High frequency products still win as they can always optimize the experience to feel superior to more generic front door versions as vertical transactional agents. I still use Granola (notes) and Cursor (coding) over other LLM solutions. This is just like how I prefer Whatsapp over texting, Spotify over Apple Music, Chrome over Safari, Amazon over Google Shopping et al. despite distribution disadvantages for all of those companies.

And if frequency is really high, you might have multiple solutions you use directly as apps on your phone or laptop. How many of you have Uber and Lyft on your phone (even Waymo)? Some combo of Doordash, Uber Eats, and Grubhub? Whatsapp, Messenger, Signal, and Telegram? There is still considerable value in being a second app in use next to ChatGPT or Google.

How founders should react to transactional agents

Opt out if you have incredibly large market share or until you get an incredible deal

Fortify brand hooks with customers via the real world where the transactions frequently take place, including potentially tighter couplings with the supply

Be the best experts in your vertical on pricing and authenticity of content or some other key lever of experience. Despite the emergence of dupe culture, there will still be some resistance to AI slop or cheap knockoffs

Supply Integration and Supply Agents

Once agents intermediate demand, suppliers will plug in directly just as every local business eventually claimed a Google Maps pin. So a marketplace’s supply, once integrated into a LLM, would not need to use the marketplace to receive more business if they can get it directly from the LLM.

The solution almost has to be a much tighter coupling of the marketplace with supply. Gilad Horev and I wrote in the past about the types of marketplace models, and many were surprised that we listed vertically integrated companies on the far right. Those aren’t marketplaces! Sameer Singh even calls these MINOs (marketplaces in name only). Why did we list them? Because, as Sameer explains, this sometimes is the only way to create a winning customer experience, despite the fact that you lose margin and network effects (both of which make growth harder).

Well, now, in addition to demand side preference on experience creating the need for vertical integration, distribution needs may force more vertical integration in some marketplace markets. Otherwise, a marketplace’s ability to acquire customers profitably and retain them may disappear, and physical real estate, standards, and the branding opportunity that affords may be the only way to survive, even at dramatically depressed margins.

Perhaps marketplaces can receive a lot of the value of vertical integration without the dramatic change in business model and maintain some of the value of their network effects in the process by integrating more directly with their supply as described in the transactional agent section.

For less physical domains, the solution may be using AI to beat AI by making agentic versions of your supply. In this model supply may have a lot of process knowledge that can be programmed into an agentic version of the supply to do tasks on their behalf, earning them more passive income than most marketplace models. Imagine Upwork or Fiverr having their agents doing 95% of the work their supply used to, at similar economics to supply.

By managing that agentic technology, that vertical agent will likely work a lot better than generic ChatGPT or any individual supplier trying to create and maintain their own agent. The agent itself can drive more discovery of other agents in the marketplace who are better at certain solutions than who a user might be engaging with at the moment. These agents improve with every “transaction” both for repeating and new customers on the demand side, creating data network effects, and their ability to recommend other agents preserves cross-side network effects as well. Each operation improves operations, gathers outcome data, and improves future matching. This is what we are working on at SuperMe.

Perhaps this leads to changes in monetization models that feel more subscription or usage-based as the marketplace now powers so many workflows for the supply. While marketplaces are no stranger to subscription models, they have historically been limited to add-ons or lead gen models where marketplaces can’t verify every transaction. Licensing data or access is not out of the question either. Cloudflare is working on this, but it feels hard for this to be the cornerstone of a strategy.

How founders should react to supply integration

Deepen the relationship with supply via workflows, full integration, or owning their individual agents and making them self-improving

Use supply AI to beat discovery and transactional AI

Be willing to change your model if you have to to preserve your value prop

The Marketplace Response Playbook to Agents (2025-2030)

Go agentic on both sides of the marketplace. Develop your supply and demand agents and capture your own structured data. Use AI to beat AI.

Reorient CAC to first order economics. Stop overpaying for traffic without identity.

Deepen Supply Integration. Offer workflow tools and consider forms of vertical integration.

Exploit Offline / Packaging Surfaces. Build recall where agents can’t completely cut you out of the experience.

Experiment with Monetization Mix. Experiment with subscriptions and data or licensing before take rate erodes.

The marketplace landscape is changing, and I urge founders to start planning major changes in how they acquire and retain users now, and be ready for more drastic changes about how they operate their businesses generally in the future. While on average these changes may be net negative for marketplaces, I predict we’ll see some incumbents and startups alike emerge to build much stronger business than we have seen in the last decade. But those who wait are more likely to perish.

Feel free to ask Casey AI more about this topic.

Currently listening to Hinterland by Aim.

Thanks to Mike Duboe for feedback on this essay.

Thanks for the write up, Casey. I'm reminded of something I wrote internally for TeePublic (an artist-apparel marketplace) way back in 2020 when Google came out with "shopping actions" and Facebook came out with "shop"...

We are at risk of being turned into an undifferentiated commodity: Google, Facebook, and Amazon are fighting a war over who owns our customers, offering users the ability to never leave their site in order to purchase our products. The issue is compounded by the fact that marketing has operated as a commodity on these platforms and reinforced this problem. Google shopping actions allow a user to search for and purchase a product without leaving Google. We cannot re-market to these users, since we are only a "fulfiller" (a nameless, faceless Google seller). We run the risk of being "Amazoned" i.e. when people ask where they got their t-shirt they respond “I got it on Google."

I think this points to your emphasis on "fortifying brand hooks with customers via the website experience post the handoff from the LLM." This has always been a problem for marketplaces: when you don't own the relationship, you're just a backend API for someone else's UX.

What got us out from underneath Google/Facebook was a heavy investment in brand, product, and the post-click experience that gave people a reason to remember us.

If your product roadmap for 2025 doesn't include "How do we compete with/become an AI agent," you're planning for yesterday's game.

This isn't just a marketplace problem—it's a PM competency problem. The best product minds are already repositioning their entire value props around this shift.

Shoutout to Casey Winters for connecting dots most of us didn't even see. This is the kind of strategic thinking that separates good PMs from great ones.